Shadow Banks Can Run—But Not Hide—From Bank Supervisors

There's no such thing as a shadow bank without a bank

A new round of commentary on Basel III Endgame has begun. As part of that discourse, we’ve again begun hearing about the potential for pushing risks outside the banking system and into the supervisory shadows.

The bank lobby uses this risk to suggest lighter bank regs and lower capital requirements: This would, their argument goes, at least keep the risks in supervisors’ sights. The anti-bank lobby underlines the same risk to argue for widening the regulatory net: If raising capital requirements pushes risk out of the system, they argue, then regulators should also get more authorities over nonbank financial institutions (NBFIs).

They’re of course both right and both wrong; it would depend on the specific circumstances. But one thing worth noting is that, to the extent bank regulators are worried about the risks of shadow banks like private credit/equity, hedge funds, etc.—and particularly that those risks might boomerang back to the banks during times of stress—they can influence such risk-taking in the normal course of supervision/regulation, and increasingly are.

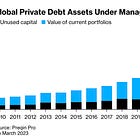

Because there is a fixed amount of money willing to take on risky investments, risk can shift to nonbanks, but there’s a limit to how much funding can move absent the growth of bank leverage. And indeed, we’re seeing increasing bank-provided leverage in private credit/equity—while banks’ prime brokerage businesses become their crown jewels. Banks are re-tranching: moving the capital risk to an external balance sheet that can be funded with a market-determined amount of capital rather than a (higher) bank-regulation-determined amount—and taking a protected stake in that risk by providing the senior funding.

Regulators are increasingly eyeing these businesses for potential risks though, and can always rein them in via their bank supervisors. As IFR interview with one of Citi’s credit executives reported, “banks get far more information about the exposure in the portfolios and funds that they finance compared to if they were buying public securities.” Supervisors can ask for this information and frown upon what they see.

I’m making no attempt to take a systematic look across the world, but here’s some recent transatlantic developments on this front—all of which come in addition to the usual flagging of such risks in official reports:

The Fed

Published alongside the Fed’s 2024 stress test of large banks was the Fed’s “first exploratory analysis.” Of the four exploratory tests, two “market shock” scenarios applied only to the GSIBs and included the simulated failure of each GSIB’s five biggest hedge fund counterparties. While these tests did not affect regulatory ratios—though it seems like that could be coming in the future (unless there’s a party change in the White House)—the Fed said that “the use of additional market shocks offers insight into how the trading books and counterparty concentrations of the largest and most complex banks would change under a range of different market conditions.” The Fed is clearly drilling down on the risks to banks from increasingly funding these shadow banks.

In June, the Fed published a draft Federal Register notice requesting comment on its plans to expand its data collection via the FR Y-14 forms—which collect supervisory information on large banks that is used for, among other things, the Fed’s stress testing and its setting of capital requirements. The information collection proposal seeks to sharply expand the level of detail the banks report on their NBFI clients/business. As just some examples, the Fed is seeking expanded reporting from banks on:

Their NBFI borrowers’ balance sheet metrics;

What specific kind of NBFI is borrowing form the bank—“(e.g., credit fund, broker-dealer, special purpose entity, etc.)”;

Whether or not their loan clients have a “financial sponsor”—i.e., whether a borrower is a private-equity-backed firm;

Reported “collateral market value,” so that the reporting includes updating the value of collateral that has no market prices.

This would presumably cover the assets that private credit/equity funds are posting for net-asset-value (NAV) loans. The increasingly popular NAV loans are used by private credit/equity funds to lever up and to fund distributions to investors. That is, they represent bank leverage being used to maintain and scale shadow banks.

Across the pond

Bloomberg, which is apparently getting really good at guessing bank supervisors’ passwords, has reported on several similar supervisory developments in the UK and Europe.

It reported the ECB is probing banks’ lending to private credit firms and their underlying funds. The Bank of England is similarly asking banks “to provide more information about their offering of net-asset-value loans to buyout funds,” inclusive of how much capital they’re allocating and how much borrower leverage they’re allowing.

Bloomberg also reported that the Bank of England’s on-site supervisors have begun asking banks “how much information their hedge fund clients are disclosing about their business and whether it was enough for [the banks] to understand the risks involved in the prime brokerage business.” The report added that the BoE was also examining banks’ rates and commodities prime brokerage business lines—and that the Federal Reserve and other foreign supervisors have also been involved. Moreover, it said:

After their review of banks’ businesses in the aftermath of the collapse of Archegos and the LDI crisis, the BOE sent letters ordering banks to clean up their equity financing and fixed income finance businesses. The central bank may do the same after its latest round of on-site reviews wraps up, the people familiar with the matter said.

Financial distress events often get described as something being the “spark” and something being the “tinder.” Trying to prevent shadow banking risk buildup by using bank supervision to squeeze shadow banks’ banking partners would be akin to simply taking away the oxygen.

Comments also welcome via email (steven.kelly@yale.edu) and Twitter (@StevenKelly49). View Without Warning in browser here.

Previous notes on shadow banking/private credit: