Crypto Winter's Next Victim: Short-Term Interest Rates?

Are so many stablecoins still needed?

The crypto carnage continues. What started as bear market last fall accelerated in April and then came for the institutional players starting in May. Terra blew up: literally to 0, both its LUNA token and its UST algorithmic stablecoin. This sharpened the broader selloff as Terra liquidated what reserve (of crypto assets) it did have. And the institutional player dominoes have continued to fall since then. In no particular order: Three Arrows, BlockFi, Voyager, Celsius, and more. Freezing withdrawals, filing for various bankruptcy chapters, restructuring. In other words: liquidating.

Where does that leave the crypto markets? Below 900B in market cap. Down from over $3 trillion in November and 1.8 trillion at the start of May.

Financial parlance often distinguishes between financial firms and “real economy” firms that are simply users of finance. I mention this just to set up that this crypto market crash has no material effect—in itself—on what I’ll call “real finance.”

There is a nexus between the real and imagined worlds of finance though, of course, in stablecoins. And the crypto selloff could suggest a glut of stablecoins.

Contrary to popular characterization of stablecoins as a place for traders to “park funds” when they want to sit out volatility, stablecoin supply cannot actually expand in response to a selloff of risk assets. This is why holding them is not akin to a “flight to cash” in the real world, where central banks can accommodate the expanded desire for liquidity. Expanding the supply of stablecoins can (with extremely limited exceptions) only come from the crypto economy onboarding more real dollars. (I discuss the balance sheet mechanics of this process in this note, so I won’t redraw this here.)

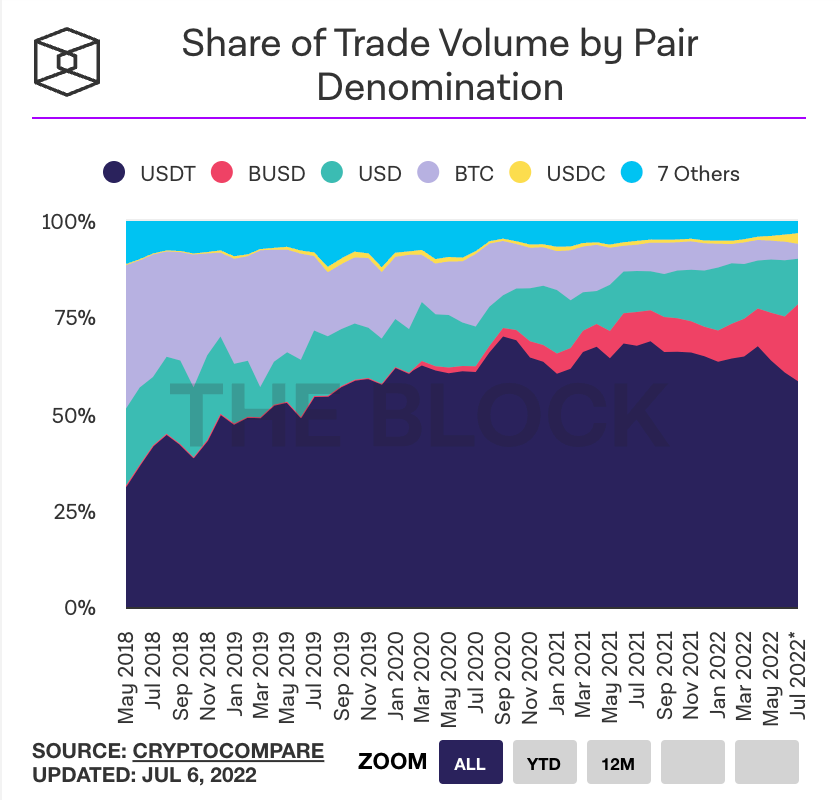

So, stablecoins are fundamentally a trading currency. They are not used for “holding” liquidity, but for lubricating trading in the cryptosphere. (And there are some fringe uses for payments right now? But its less clear why you’d keep them on-chain if not continuing to trade crypto with them.) And this raises an important question: are all these stablecoins here for much longer?

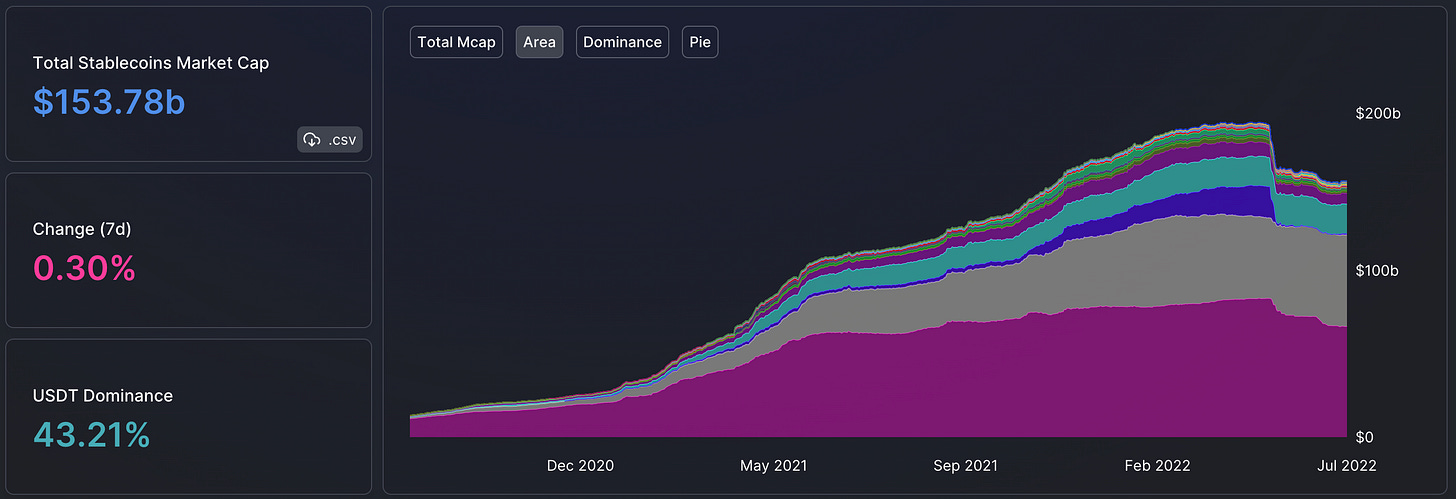

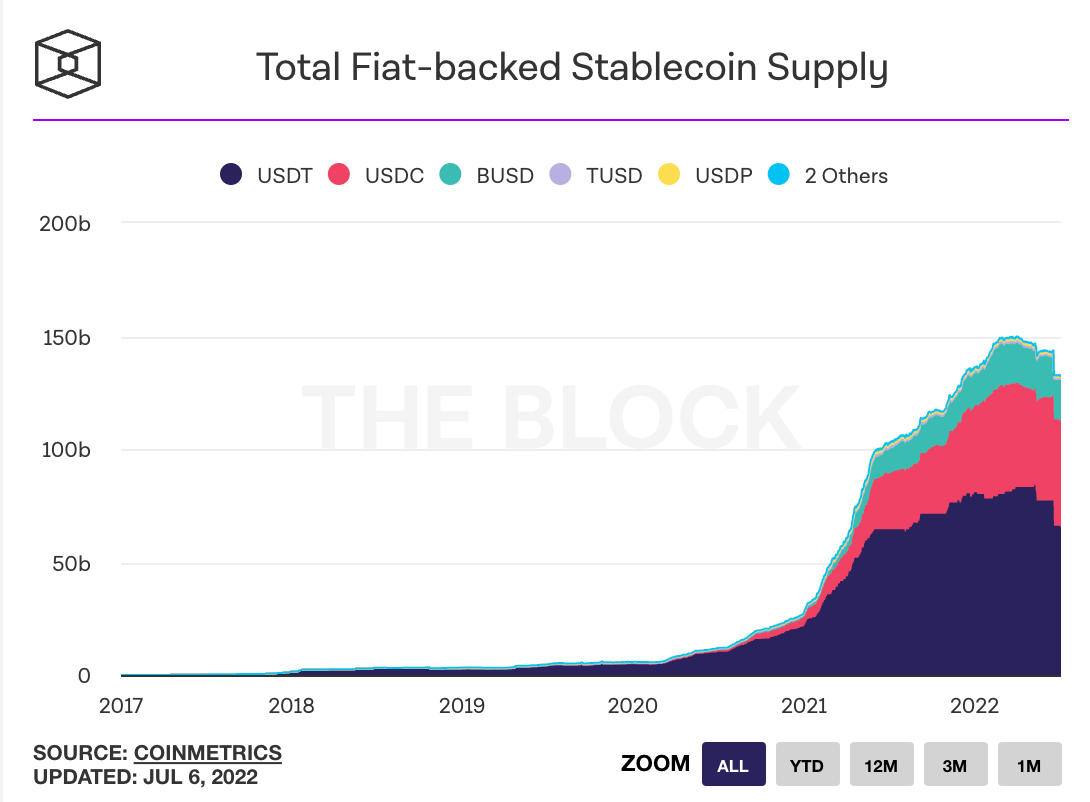

The supply of stablecoins initially rose at the onset of the crypto bear market (helping perpetuate the myth that it was some sort of “flight to cash” as opposed to newly onboarded fiat), but the latest bearishness has finally begun to push supply down. (The top picture is slightly exaggerated because it shows Terra’s UST going from $19B to 0. The bottom picture is more important for its potential knock-on effects to real finance.)

Roughly speaking, if crypto market cap has fallen by 2/3, the quantity of transactions would have to have tripled to require the same amount of stablecoins as before (for transaction purposes). Instead, trading volume appears to be in a relative lull in this bearish environment replete with locked accounts.

So, forget the questions over stablecoins’ safety or their ability to redeem for a second. The perhaps even more immediate question is: what are they good for right now? Yes, there’s the fringe stories here and there of someone in Venezuela being able to pay someone in Iran - fine. But stablecoins are one leg of some 70+% of crypto trades — a big use case for stablecoins. Tether and BUSD in particular:

So, even granting that there is some floor on fiat-backed stablecoins for the stray payment from Turkey to Russia, if $150 billion of dollar reserves was holding up the crypto market at $3 trillion, it’s not clear why $132 billion is needed with the crypto market at $900B (and the $132B is included in that $900B!).

Point being: the net $18B liquidation of dollar reserves we’ve seen may be just the beginning. $132 billion is still a small enough amount that, absent substantially greater real-world financial stress, it could all be liquidated without systemic effect. But, this may either way be an underappreciated risk for the short-term interest rate complex.

Even assuming stablecoins meet any and all redemptions seamlessly, as they’re wont to brag about their ability to do, this would not be an immaterial asset dump. USDC’s $55B is $44B of short-term Treasuries and $11B of bank deposits. BUSD’s $17B is in Treasury bills, Treasury repos, bank deposits, and money market funds. Tether’s $66 billion has a bit over $30B in Treasury bills and $20B-ish in commercial paper, bank deposits, and CDs. These amounts are not astronomical, and more than covered by available liquidity in the system, but STIR traders should be watching.

Moreover and as alluded to above, this otherwise not-systemic sum can become very systemic in the event of a real world financial panic, when funding markets are already experiencing runs. There are all sorts of reasons a firm might lose funding in a market panic, when every billion counts. But people simply leaving the crypto economy and forcing stablecoins to pull their liquidity from their counterparties and send it elsewhere—where it might not find its way back to the borrower in need, especially overnight—is by far the stupidest reason.

Comments are turned off here but more than welcome via email (steven.kelly@yale.edu) and Twitter (@StevenKelly49).